Orkney and the Energy Markets

- Evaluating price as a deciding factor in an Orkney aggregator

Introduction

The role of an aggregator is to control a collection of assets that are able to store and release energy. This enables it to adjust its load to the state of the grid, charging and discharging when it sees fit. In a world of fluctuating energy generation and demand, this is a very useful mechanism. But an aggregator needs one or more parameters to optimize for, to base its decisions on. An obvious choice of parameter is the prices of the wholesale electricity market. Buy power when it is cheap, sell when it is expensive. This makes sense from a business perspective.

In the case of an Orkney aggregator, there are other things to consider than just the revenue. Orkney is capable of producing an abundance of renewable energy - far more than what is needed to power the islands - but only when the wind is blowing. And often when the wind is blowing, the grid is unable to accommodate all of the electricity, resulting in generator curtailment.

If we want to utilize the renewable energy produced in Orkney as much as possible, we need a more flexible grid. An aggregator can serve as a collective buffer for the islands, storing energy when generation is high, and releasing it back when generation is low.

In this post, we look at how well using the wholesale price of electricity serves as a proxy parameter for optimizing the utilization of Orkney’s renewable energy capacity.

Data Analysis

To examine this issue, we will use three different time series datasets:

- Renewable energy generation and demand on Orkney as reported by SSEN1

- Auction prices from the N2EX day-ahead market for wholesale electricity2

- Energy generation for the entire UK as reported by REF3

We analyze the data using Python, importing each of the datasets into pandas DataFrames and joining them on their timestamp. This allows us to evaluate our assumptions by plotting the different data columns against each other in a scatter plot (using matplotlib) and looking for correlations.

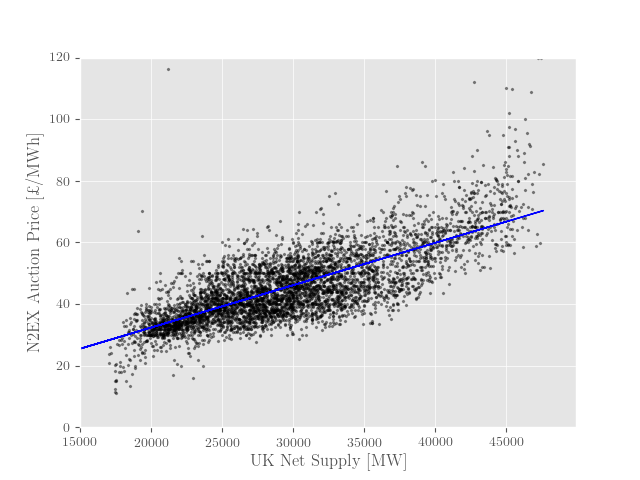

A correlation in a scatter plot can be identified if the data points seem to follow a non-horizontal line, either straight or curved. An example of a fairly strong correlation in our data, is that between the UK net supply of electricity and the day-ahead prices (Figure 1). This makes sense as the price is set based on the estimated demand, and the generation follows the demand quite closely.

Intuitively, we would imagine that electricity is cheap when it is abundant, and expensive when it is scarce, making the price and the corresponding revenue an attractive and tangible parameter to optimize for. But as Orkney is connected to electricity markets that cover the entire UK, which is powered on a host of different energy sources, this connection is not so obvious.

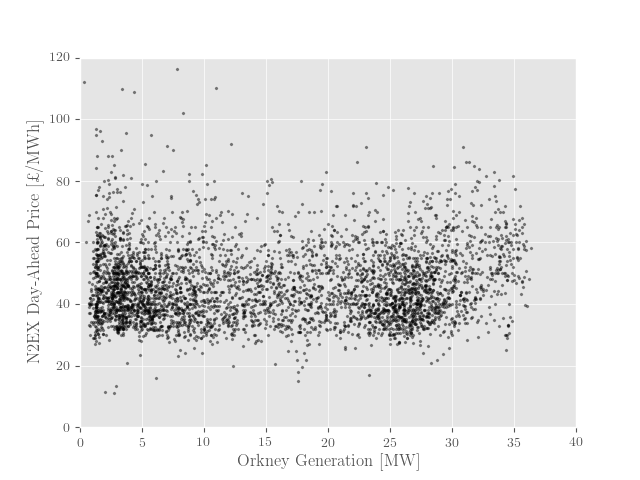

In fact, if we compare the renewable generation in Orkney with the prices at closing time from the N2EX Day-ahead market for the first seven months of 2019, we see no correlation at all (Figure 2). This indicates that the price of the day-ahead market is a poor predictor of energy generation in Orkney.

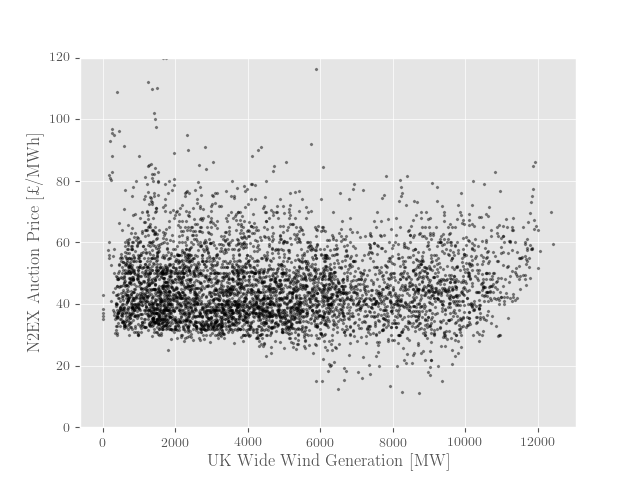

The day-ahead auction closes at noon, 12-36 hours ahead of delivery, which might explain in part why is does not reflect the very volatile generation of wind energy. There is no noticeable connection between UK-wide wind generation and N2EX prices either.4

There are other types of electricity markets that operate on an intraday level, with auction intervals between 15 minutes and two hours ahead. These markets might better reflect the fluctuations in wind energy, but they are UK wide markets as well, limiting the influence of Orkney’s generation.

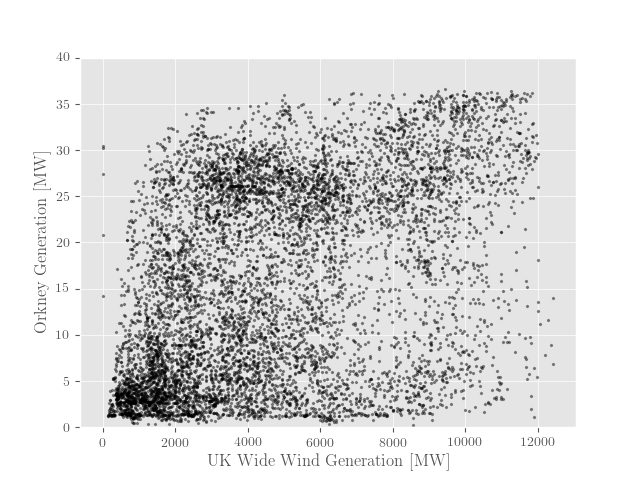

From the data collected, there does not seem to be a tight relationship between renewable energy production in Orkney and the wind production in the UK as a whole (Figure 3). From the scatter plot we can see that often when generation is low in Orkney, it is also low in the rest of the UK. But there is also a lot of data points toward the upper left corner, indicating times when generation is high in Orkney, but lower throughout UK. In general, the data is fairly scattered, indicating only a weak relationship. This means that even a market that reflects wind generation in its prices still does not serve as a good proxy for Orkney generation if it caters to the entire UK.

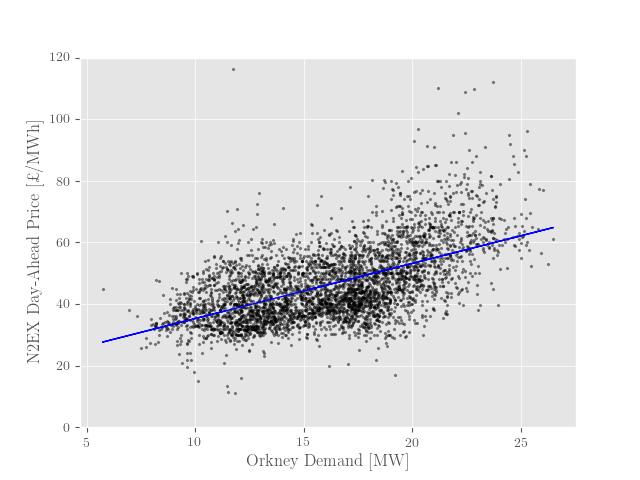

There is a correlation between the power demand in Orkney, and the N2EX prices,5 which is likely due to the fact that they are both governed by the same daily, weekly and yearly rhythms in human power consumption.6 This means that the prices can serve as an indicator of the demand in Orkney.

Conclusions

In this post, we have looked at data representing the generation of renewable energy in Orkney, the generation of wind energy in the entire UK, and the day-ahead auction prices in the N2EX wholesale electricity market. We found no visible correlation between the generation of renewable energy in Orkney and the wholesale electricity prices. We further found that there is a very limited correlation between the renewable energy generation on Orkney (which is primarily wind based), and the UK wide wind energy generation. This implies that even if the UK wide electricity market did reflect the fluctuations of wind energy in its prices, it would still not reflect the situation in Orkney very well.

Our analysis indicates that while wholesale electricity prices might be a good deciding factor for optimizing profits, it does not serve as a suitable indicator for the generation of renewable energy in Orkney. If the purpose of the aggregator is to increase the utilization of renewable energy and thereby decrease greenhouse gas emission, it must base its decisions on other factors than the wholesale electricity market.

- Continuously collected from https://www.ssen.co.uk/ANM/ - available as CSV here. [return]

- Collected from https://www.nordpoolgroup.com/historical-market-data/ - available as CSV here. [return]

- Collected from https://www.ref.org.uk/fuel/ - available as CSV here. [return]

[return]

Figure A: Relationship between UK wide wind energy production and N2EX prices

[return]

Figure B: Relationship between Orkney demand and N2EX day-ahead auction prices If we decompose the Orkney demand, the N2EX prices and the UK-wide net supply into a weekly seasonal component and a larger trend, we see how they follow the same general temporal patterns.

[return]